For the third time in a row, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) today slashed interest rates by 25 basis points, as was widely expected.

The MPC consisted of members like (Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Shaktikanta Das) unanimously decided to reduce the policy repo rate by 25 basis and change the stance of monetary policy from neutral to accommodative.

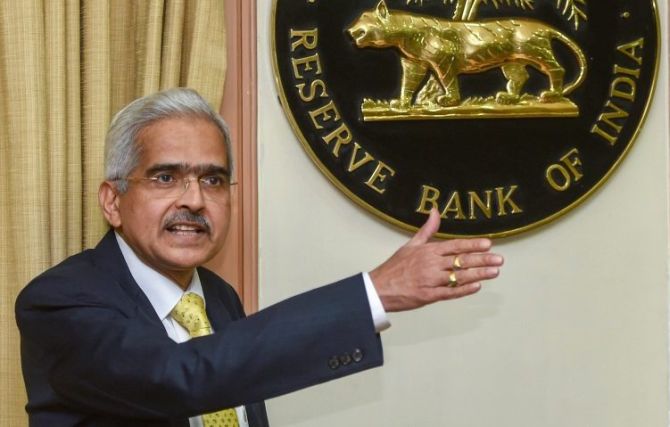

After its three-day MPC meeting, RBI Governor Shaktikanta Das announced its second bi-monthly monetary policy statement for 2019-20.

In the midst of slowing economic growth and rising global uncertainty, the RBI had decreased the short-term lending rate (repo rate) by 25 basis points each in its last two policy reviews.

RBI Governor Shaktikanta Das said they would ensure that adequate liquidity is there in the system.

With a sharp slowdown in investment activity along and moderation in private consumption growth, the MPC said growth impulses have dropped significantly as reflected in a further widening of the output gap compared to the April 2019 policy.

There has been an upward bias to inflation outlook due to stronger than expected vegetable prices. Significant weakening of domestic and external demand conditions show downward bias. Crude prices have continued to be volatile, but impact on CPI has been muted.

The near-term household inflation expectations have continued to remain steady. Risks to inflation projection from uncertainties relating to the monsoon. Risks to inflation forecast from unseasonal spikes in vegetable prices

Risks to inflation forecast from international fuel prices and their pass-through to domestic prices

Other risks include geo-political tensions, financial market volatility, fiscal scenario.

Inflation expectations of households in the May 2019 round of Reserve Bank’s survey dropped by 20 basis points for the three-month ahead horizon compared with the previous round, but remained unchanged for the one-year ahead horizon.

RBI has seen a consumer price inflation forecast for the first half of fiscal year 2019-20 to 3-3.1% from 2.9-3% earlier, while the projection for the second half stands revised to 3.4-3.7% from 3.5-3.8% earlier.

The MPC revisited both its growth and inflation forecasts for the current fiscal. GDP growth has been revised downwards to 7% from the earlier projection of 7.2%. The MPC expects growth in in the range of 6.4-6.7% in the first half of FY20 and 7.2-7.5% in the second half.

RBI’s policy statement was followed by a press conference with the central bank governor and his deputies.

Previously, the RBI had to cut rates three times in a row back in 2013.

Even as the RBI has decreased the repo rate by 50 basis points to 6% since February, bank lending rates, on an average, have dropped by only 5 basis points.

Rating agency Icra expects the RBI to maintain a neutral in its monetary policy review. The agency said the central bank would wait until the new finance minister Nirmala Sitharaman presents her first Budget on July 5.

A recent report by SBI had advocated that RBI could go for a rate cut bigger than the widely-expected 25 basis points keeping in mind the current slowdown in the Indian economy.

India Ratings had earlier said that rate cut is unlikely to facilitate growth.

Apart from its likely rate cut, the RBI will have to tackle issues surrounding sluggish monetary policy transmission. In spite of lowering rates by 50 basis points this year, bank lending costs have been rather uneasy because of tighter liquidity.