The corporate performance for the March quarter of FY19 has improved on a quarterly basis as compared to last year, said CARE Ratings in its research report.

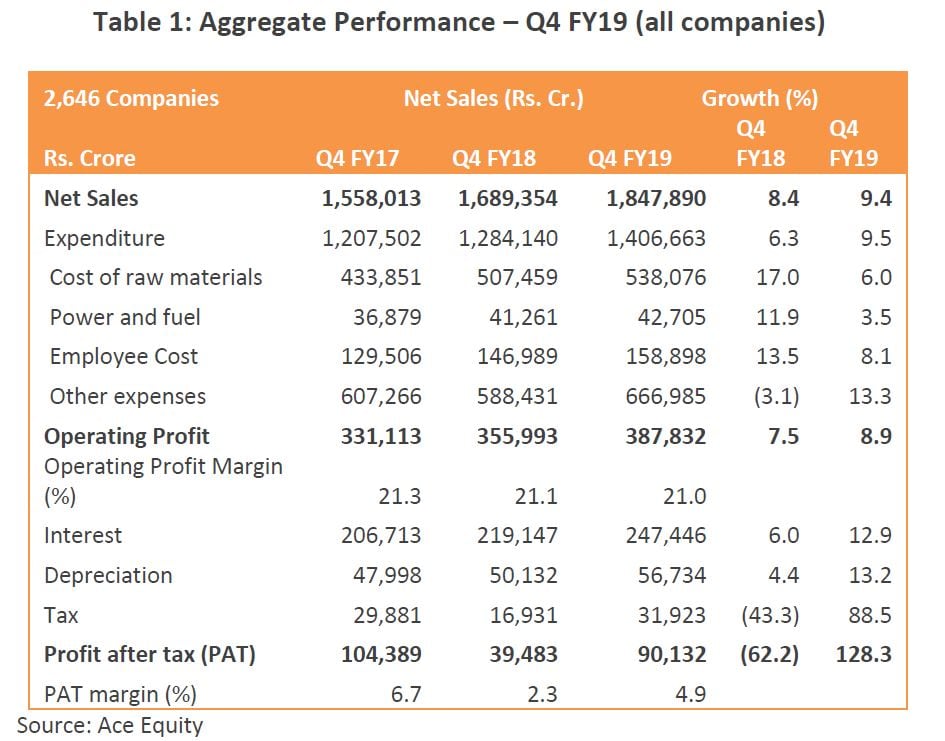

The rating agency said that the results of a sample of 2,646 companies suggest that the net sales have grown at 9.4 percent compared with 8.4 percent in Q4FY18. The profit margins also more than doubled from 2.3 percent in Q4FY18 to 4.9 percent in Q4FY19.

“Operating profit margin remained stable at around 21 percent in Q4FY19. Expenditure has grown by 9.5 percent compared with the 6.3 percent growth in the comparable quarter last year. Cost of raw material accounts for nearly 38 percent of the total expenditure in Q4FY19,” added the research report.

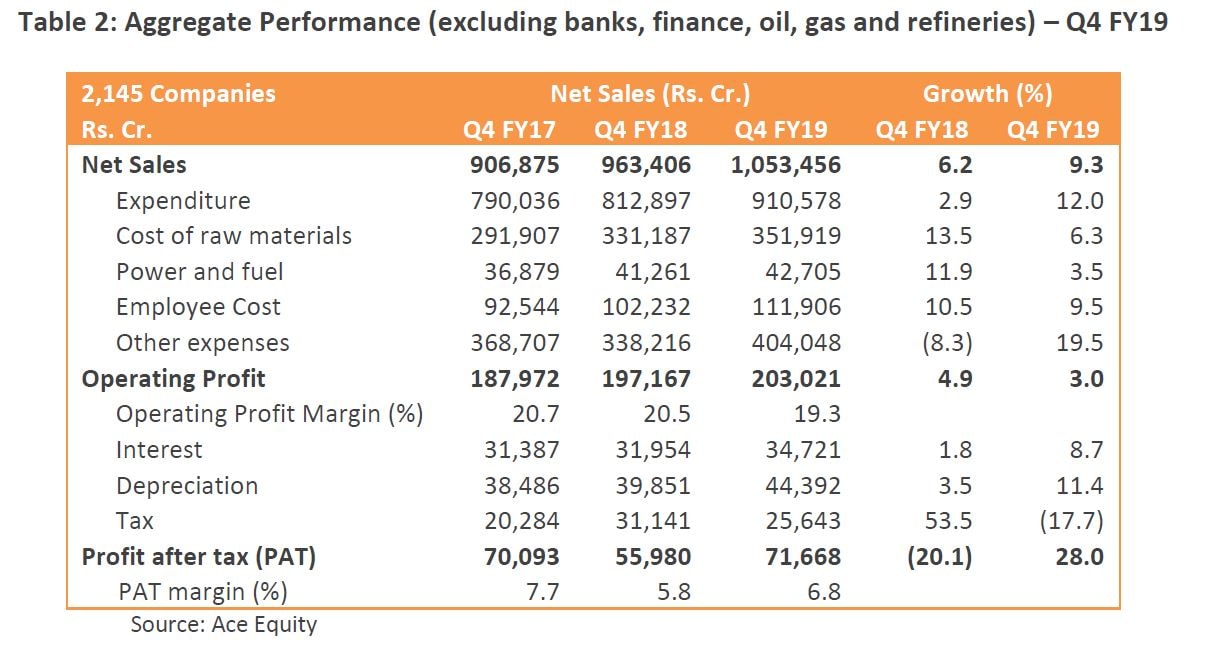

Separately, the financials of a sample of 2,145 companies which excludes banks, finance, oil & gas and refineries have registered net sales growth at 9.3 percent in Q4FY19 compared with the 6.2 percent growth in the corresponding quarter last year, it added.

According to the report, most of the industries have indicated improved performance during the quarter.

Sugar: In Q4 FY19, the net sales of the industry have grown by 17.6 percent compared with the contraction by -19.5 percent in the comparable quarter last year. The industries have moved into net profits to the tune of Rs 2,360 crore in Q4FY19 as against the net losses worth Rs 255 crore in Q4FY18.

Automobiles: In terms of sales, the industry witnessed a muted growth of 0.8 percent in Q4 FY19 vis-à-vis a double-digit growth of 13.7 percent during Q4 FY18. Similarly, IIP of motor vehicles, trailers and semi-trailers witnessed a decline of 4.5 percent in Q4 FY19 vis-à-vis a sharp growth of 20.4 percent during the corresponding period of the previous year.

Banking: The performance of private as well as public banks has improved during the fourth quarter of FY19. The net sales have grown at 15.1 percent while the net profits have registered a growth of 20.8 percent compared with a decline by -10.7 percent in Q4FY18.

IT: The performance of this sector has improved substantially during the quarter. Net sales of IT – software companies have grown at 18.8 percent in Q4 FY19, higher than the 6.9 percent growth in Q4FY18. Likewise, the growth in net profits was registered at 11.7 percent compared with the 8.3 percent growth in the comparable quarter last year.

Finance: Finance sector, led by housing finance and NBFCs, has registered impressive growth during the quarter. The net sales and net profits continue to grow at double-digit growth rates at 15.7 percent and 21.5 percent respectively, though these growth rates were marginally lower than those in Q4FY18.

Metals: The performance of the metal industry has deteriorated in Q4FY19. The net sales have grown at a lacklustre pace of 0.9 percent compared with the 9.5 percent growth in Q4 FY18. Net profits have declined by -17.8 percent than the 3.9 percent growth in the corresponding quarter last year. The primary factor dragging the performance is the decline in prices of metals that had an impact on the sales and profit margins.

Oil/Refinery: The net sales have grown at subdued 5.4 percent in Q4FY19 compared with the 14.9 percent growth in Q4FY18. The industry has registered a decline in net profits by 1.6 percent as against the growth of 17.4 percent in the comparable quarter last year.

FMCG: The industry registered double-digit growth during the quarter – net sales grew by 11 percent while net profits expanded by 32.7 percent in Q4FY19. Growth in net sales was seen mainly owing to price hikes of certain products, especially in the consumer food and beauty and personal care segments. The emergence of ecommerce helped improve distribution reach.

Cement: This sector has registered a growth by 13.3 percent in net sales and 23.6 percent in net profits during Q4FY19.

Real Estate: Real estate’s net sales and net profit have increased each by 20 percent year-on-year in Q4FY19. Bank credit off-take by the sector has also increased by 8.9 percent as on March 2019 compared with the 0.1 percent growth as on March 2018 indicative of pick up in the activity in this segment.

Telecom: Telecom industry witnessed a revival in Q4FY19. The year-on-year net sales growth stood at 24.2 percent compared a contraction by -17.8 percent in Q4FY18. Similarly, net profits grew by 6.4 percent in Q4FY19 as against a decline by 28.5 percent in the comparable quarter in Q4FY18.

Pharma: The net sales have grown by 10.9 percent in Q4FY19 vis-à-vis 9.3 percent growth in the corresponding quarter in the previous year. Similarly, net profits growth has remained stable at around 22 percent year on year in Q4FY19.

Paints: The net sales of the industry have grown impressively by 10.2 percent in Q4FY19 compared with muted growth by 0.7 percent in the Q4FY18. On the contrary, net profits grew moderately at 0.3 percent in Q4FY19 over the 11.9 percent growth in the comparable quarter in FY18.