Sebi refuses to share documents pertaining to insider trading charges against the duo as it could hamper investigation

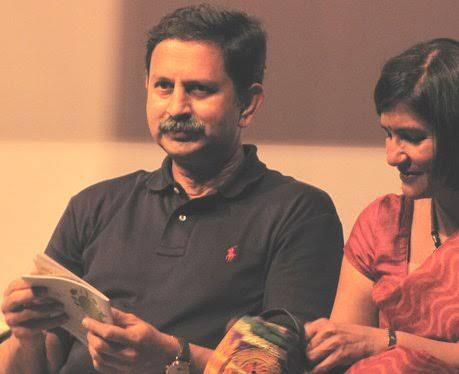

In yet another setback for Atul and Rahul Kirloskar, the Appellate Authority of the Securities and Exchange Board of India (Sebi) has rejected their applications seeking documents under the Right to Information (RTI) pertaining to SEBI’s probe of insider trading and fraud charges against them. The Economic Times has reported this development.

Sebi is conducting an inquiry against Atul and Rahul in relation to the violation of SEBI (Prohibition of Insider Trading) Regulations and the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Markets) Regulations, 2003. It is alleged that Atul, Rahul and their family members indulged in insider trading and fraud by selling their shares of Kirloskar Brothers Limited (KBL) to another listed company, namely Kirloskar Industries Limited (KIL).

While rejecting the applications, the Appellate Authority under the RTI, said that the investigation was still ongoing and disclosing the documents at this stage could hamper the probe. “.. I find that investigation is in progress and the matter has not reached a logical conclusion. I am of the opinion that the disclosure of requested information would be premature to the process of examination/investigation and may also impede the subsequent proceedings (if any).”

Atul Kirloskar had initially approached Sebi on January 6, 2020, seeking documents pertaining to status/outcome of each of the investigation/inquiries conducted by SEBI in 2012, 2016, 2017, 2018 and 2019, respectively, in relation to the sale of 1,07,18,400 shares of KBL to KIL on October 06, 2010.

Apart from seeking internal notes and internal administrative orders, Atul had also sought “relevant portions of additional information/fresh evidence as recorded and contained in the related files that formed the basis for conducting of repeated investigations in respect of the 2010 Transaction”.

Rahul had filed similar application and appeal and also sought copies of any correspondence/show-cause notices issued to any third party by Sebi in the matter.

Sebi rejected their applications on January 28 stating that the issue is still under investigation and has not reached a logical conclusion. Apart from the fact that the information was exempted under the RTI Act, Sebi said that the information was available to it “in fiduciary capacity and disclosure of the same may also impede the process.”

Atul and Rahul then approached the Appellate Authority on February 25 on the grounds that the documents/information sought by them was rejected by Sebi.

Ideally the Appellate Authority has to decide on an appeal within 30 days. However, this appeal could not be disposed of within the stipulated 30 days, owing to official exigencies and nationwide lockdown due to coronavirus pandemic. The appeal was heard and decided on April 20th.