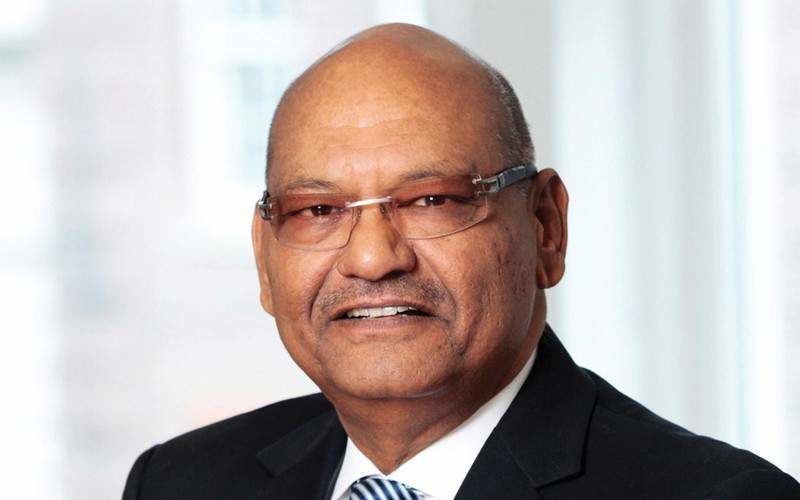

Anil Agarwal, the founder and chairman of Vedanta Resources, has reportedly requested the government to privatise five mining companies, including Hindustan Zinc, which will help India cut USD 400 billion of its that it spends annually on imports.

The billionaire metals tycoon were one of the three industrialists invited for a pre-Budget meeting with PM Modi, said the government mustn’t go into the mining business.

Prime Minister Narendra Modi on Saturday held a meeting with leading economists to review the macroeconomic situation of the country and to deliberate upon economic policy roadmap for boosting growth and employment generation. The meeting was presided by over 40 economists and other experts, organized by NITI Aayog, on the theme “Economic Policy – The Road Ahead.” reported PTI.

“I was honoured to be part of the interaction organised by Niti Aayog on Saturday and in my humble submission I told the Prime Minister that the government has no business to be in the business. It should divest its stake in at least five PSUs such as Hindustan Zinc, Hindustan Copper, Kolar Gold, Uranium Corporation, Shipping Corporation of India and NMDC,” Agarwal told PTI in an interview.

“When we bought the majority stake in Hindustan Zinc Ltd, it had 5,000 employees. Today it has 25,000 employees,” he said.

Vedanta had bought a 64.9 per cent government stake in Hindustan Zinc Ltd (HZL) during 2002-2003. As of now, the government holds 29.5 per cent stake in HZL, which Agarwal-led company wants to buy.

Agarwal also warned that India’s import bill of USD 400 billion may soon go up to USD 1 trillion if the government does not increase the output of oil and gas, minerals and metals such as gold.

He also felt it is better that government stake in state-owned companies be slashed while banks drop to 50 per cent. It could also help them board-run just like British Airways and GE.

All PSUs and PSBs can perform three times better if autonomy is given to them, he said. PSUs have huge potential and immense talent pool. Executives have been afraid to take decisions because of fear of inquiries. They should be empowered to take decisions.

The other two industrialists invited to the interaction were Tata Group Chairman N Chandrasekaran and ITC Chairman Sanjiv Puri. Chandrasekaran gave suggestions on manufacturing and services sectors, while Puri stressed on value addition in the economy, say news reports.