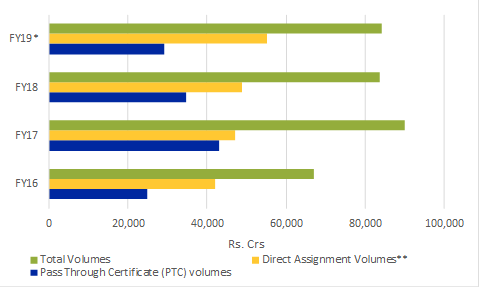

Securitisation market has witnessed heightened activity in recent times driven by large scale funding requirements of NBFCs and HFCs. According to ICRA research, securitisation volumes soared to around Rs. 18,000 crore in the month of October 2018 alone, with many entities raising funds through retail portfolio sell-down to banks. In comparison, the securitisation volumes were around Rs. 66,300 crore till H1 FY2019 and around Rs. 83,800 crore for the entire fiscal 2018. These funds helped meet the sizeable repayment obligations of the NBFC sector (around Rs. 78,000 crore of Commercial Paper (CP) was due for repayment in October 2018) in an otherwise difficult market, says ICRA in the report. The securitisation market in India can be segregated into two types of transactions – rated Pass Through Certificate (PTC) transactions, and unrated Direct Assignment (D.A.) transactions (bilateral assignment of pool of retail loans from one entity to another).

Other funding avenues had dried up for the NBFC sector, with capital market investors becoming wary of taking incremental exposures to some entities and general freeze in the credit markets owing to tight liquidity. Highlighting the current industry trend in the securitisation market, Vibhor Mittal, Group Head – Structured Finance, ICRA, says, “The advantage of securitisation transactions – especially in the current market scenario – is that the investors are not exposed to entity level credit risk and are seen taking exposure to the underlying pool of retail borrowers to whom these entities have lent. Even banks that have exhausted single party credit limit to an entity can do business with that entity by buying its retail loan portfolios. Both public and private sector banks have participated in a big way. However, yields have gone up significantly (by around 100-200 basis points in October 2018 compared to H1 FY2019), as the market dynamics have changed completely – from being a Sellers’ market earlier to becoming a Buyers’ market now”.