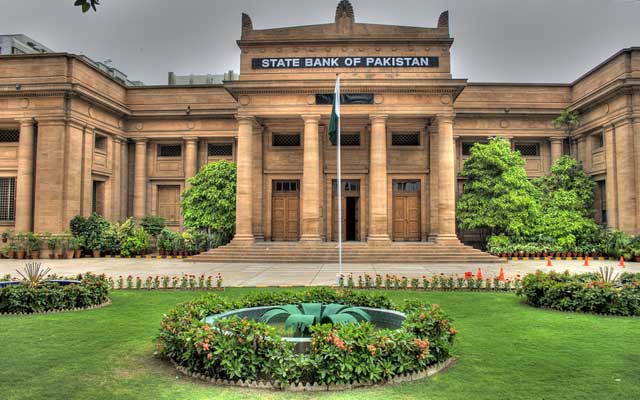

The State Bank of Pakistan (SBP) has taken stringent measures to tighten currency movement within the country amid depreciation of the national currency following the grey-listing of Pakistan by the Financial Action Task Force (FATF).

The central bank issued a detailed set of instructions on Saturday to all the money exchange companies, instructing them to help the bank keep a strict vigilance over currency movements, reports a news agency.

According to the instructions, the money exchange companies will have to properly document and record the purpose of the currency movement after necessary authorisation in its system on real time basis by its head office.

The central bank has also decided to allocate working capital to each outlet of the exchange companies for carrying out transactions, keeping in view the business needs of the head office of the respective exchange company.

This would help the State Bank to keep a check on the movement of the Pakistani rupee and foreign currencies within the company’s authorised network.

Pakistan was placed on the grey-list on June 28 by by the FATF, an inter-governmental body which combats money laundering and terror financing among other things, for failing to curb terror financing on its soil.

The decision to put Pakistan on the “grey list” was taken in February but then the country was given relief till June to combat the issue.

Pakistan had been included in the list from 2012 to 2015.