The Board of Directors of Kotak Mahindra Bank (“Kotak Bank”) took on record the unaudited standalone and consolidated results for Q3FY19, at the Board meeting held in Mumbai.

Kotak Mahindra Bank standalone results:

Net Interest Income (NII) for Q3FY19 increased to Rs.2,939 cr from Rs.2,394 cr in Q3FY18. Net Interest Margin (NIM) for Q3FY19 at 4.33%

Bank PAT for Q3FY19 increased to Rs.1,291 cr from Rs.1,053 cr in Q3FY18 up 23%. In accordance with the RBI communication, provision for mark-to-market depreciation on AFS and HFT investments continue to be presented under Provisions & Contingencies. However, if above provision for mark-to-market depreciation were treated as part of “Other Income”, the adjusted income will be higher by Rs.271 cr. Consequently, the Bank’s operating profit for Q3FY19 would have been Rs.2,210 cr up from Rs.1,793 cr in Q3FY18, a growth of 23%.

Advances as on December 31, 2018 were up 23% to Rs.196,432 cr (Rs.159,071 cr as on December 31, 2017)

CASA ratio as on December 31, 2018 stood at 50.7 % compared to 46.7% as on December 31, 2017. Average Savings deposits grew by 34% to Rs.73,958 cr for Q3FY19 compared to Rs.55,397 cr for Q3FY18. Average Current Account deposits grew by 19% to Rs.29,607 cr for Q3FY19 compared to Rs.24,776 cr for Q3FY18. TD Sweep deposits as on December 31, 2018 were 6.7% of the total deposits.

Capital adequacy ratio of the Bank, including unaudited profits, as per Basel III, as on December 31, 2018 is 18.1% and Tier I ratio is 17.6%.

As on December 31, 2018, the Bank had a network of 1,453 full-fledged branches and 2,270 ATMs affording it the capacity and means to serve its customers through its wide presence.

As on December 31, 2018, GNPA was 2.07% & NNPA was 0.71%. As on December 31, 2018, SMA2 outstanding was

Rs.344 cr (0.18% of net advances).

Consolidated results at a glance:

Consolidated PAT for Q3FY19 increased to Rs.1,844 cr from Rs.1,624 cr in Q3FY18

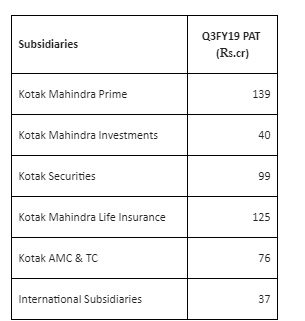

For Q3FY19, the Bank’s contribution to the PAT was Rs.1,291 cr. The subsidiaries & associates net contribution was 30% of the consolidated PAT. The contribution of key subsidiaries is given below:

Consolidated Capital & Reserves and Surplus as on December 31, 2018 was Rs.56,186 cr (Rs.48,621 cr as on December 31, 2017). The Book Value per Share was Rs.291.9

Consolidated Advances were Rs.232,756 cr as on December 31, 2018 (Rs.195,652 cr as on December 31, 2017)

Total assets managed / advised by the Group as on December 31, 2018 crossed the Rs.200,000 cr mark and were up 11% at Rs.203,222 cr (Rs.182,879 cr as on December 31, 2017).

Digital Update:

Digital remains an area of focus for the Group. We launched India’s first AI-powered voicebot in the banking sector by the name of ‘Keya’ which is now integrated into our mobile app and also available on Google Assistant. Kotak also became one of the first banks in India to pilot the Whats App enterprise solution to offer a range of banking services and answer queries. As on 31st December, 2018 we had ~3 lakh registered users on WhatsApp and received ~10 lakh opt-ins. Kotal Mahindra Bank is also now live on Ripple blockchain platform for inward remittance transactions.

Bank and other subsidiaries like Securities, Insurance, Mutual Fund and Kotak Prime are gaining significant traction and market share. In December 2018, we recorded the highest UPI transactions in a month (~31 Million) since launch. During Q3FY19, the share of Recurring Deposits sourced digitally was 89% and that of Term Deposits was 68%. Mobile banking growth in terms of volume recorded a YoY growth of 221%. The digital share of salaried personal loans was 35% in Q3FY19. Kay Mall transactions (mComm+ eComm) have grown 198% YoY in terms of volume in December 2018. AEPS volumes & value have grown 400X in Q3FY19 since their launch in Q2FY19.

Kotak Securities mobile transaction cash ADVs grew 37% YoY in Q3FY19. 90% of the individual policies written by Kotak Life Insurance were sourced through Genie – tablet based end to end sales solution. Further, 96% of the Banca channel sales in Q3FY19 were through Genie. In the case of Kotak General Insurance, its digital business in terms of volume grew 90% YoY.