Economists expressed concerns over a sharp slowdown in the Indian economy and pitched for a monetary policy boost to support growth at a meeting with the Reserve Bank of India (RBI) chief on Tuesday, according to three participants.

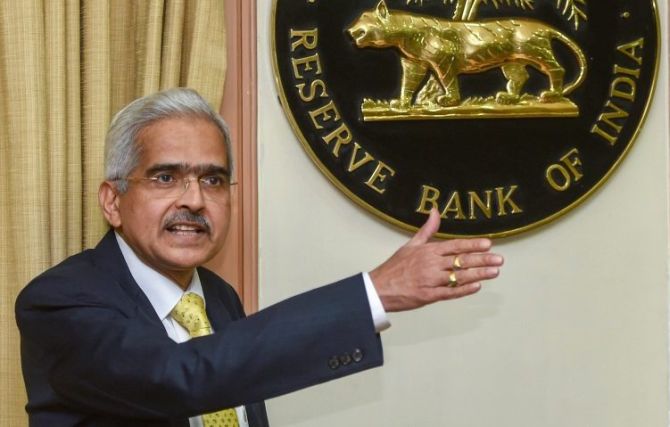

RBI governor Shaktikanta Das met more than a dozen economists to get their views on the economy ahead of the Monetary Policy Committee (MPC) decision due on April 4.

Most economists expect the six-member MPC to reduce the repo rate by 25 basis points for the second time in a row next month to 6.00 percent, a level last seen in August 2017.

Since the economists did not specify the extent of rate cut that the RBI could consider, one of them called for a 50-basis- point reduction, said one participant.

Another person said the participants of the monetary policy need to do the heavy lifting to boost growth as there was no space for fiscal expansion.

The meeting under Das, who took charge in December, was in sharp contrast to the previous ones under former governor Urjit Patel, who was slightly reclusive and preferred to meet a smaller group of economists. Das however, has been more open and communicative.

India’s economy has reached 6.6 percent during October-December, its slowest pace in five quarters, on weak consumer demand and investments, dealing a major blow to Prime Minister Narendra Modi as he seeks a second term in office at a general election that kicks off next month.

Slowing growth has taken a hit on government’s tax collections, constraining its ability to substantially boost spending ahead of elections.

Neither Das nor any RBI official from the monetary policy department gave any indication of their thoughts or views, as is typical in such big-group meetings.

Economists and strategists spoke of several issues including drought, liquidity management, exchange rate, inflation, growth, bank credit growth, real interest rates and monetary policy transmission.

One economist who attended the meeting said that it went on for two-and-a-half hours as there were many participants. The RBI hasn’t yet commented on the meeting with economists.

Some economists pointed out that food inflation could begin inching up after September if monsoon rains were not sufficient, but was unlikely to push retail inflation past the RBI’s 4 percent target.

Consumer inflation was at 2.57 percent on-year in February as food prices continued to fall for a fifth straight month.

The economists also raised concerns over a slowdown in global growth that has hurt India’s exports. India’s outbound shipments grew 2.4 percent annually in February, slower than 3.7 percent in January.

A participant added the view was that the downside risks to growth have increased since the last policy while inflation risks have remained muted. He said that none of the economists specified how much rate cut they wanted, but all of them presented the facts to make it clear to RBI that there is a need for a big boost to the economy.