By Seema Yadav

Research Analyst, IndiaNivesh

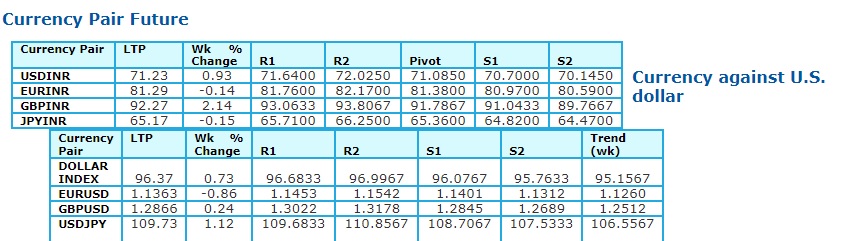

Dollar/Rupee witnessed 0.93% speculative bounce back from the weekly low 70.5225 and settled at 71.2250 levels. Jitters of EU-UK exit and surge in Brent had brought sharp demand for the greenback.

Dollar/Rupee witnessed 0.93% speculative bounce back from the weekly low 70.5225 and settled at 71.2250 levels. Jitters of EU-UK exit and surge in Brent had brought sharp demand for the greenback.

Further, China reported that its exports data shrank the most in two years in December, which fanned fears of global growth slowdown also supported in gain. From the domestic front, wholesale inflation in the month of December plunged to eight-month low on sharp moderation in vegetable prices and food prices while CPI also remained at slowest pace which had a neutral impact on the Rupee.

However, it slipped from the weekly high 71.4475 after Reserve Bank of India intervene in order to stem the volatility. Technical, bullish engulfing pattern resulted in more than 60 paisa gain in USDINR last week. Pair breached its resistance 70.80 and tested first predicted level of 71.35.

Near term trend is appears to remain bullish following to long bullish candle stick on the weekly chart. And any temporary correction towards 70.95-70.90 is expect to attract buying activities for the target 71.50-71.75. On the downside crucial support is 70.50-69.80.