The Reserve Bank of India’s announcement of new open market purchases of government bonds is a sign the central bank is using great efforts to increase the economic impact of its policy decisions, analysts say.

The RBI’s two rate cuts this year, totaling 50 basis points, have not been in sync with moves of a similar magnitude by commercial banks, which are reluctant to take risks while sitting on a pile of non-performing loans.

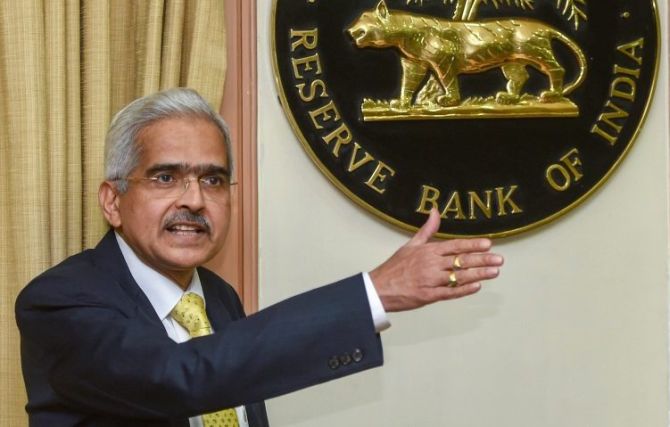

But RBI Governor Shaktikanta Das, who came to the post in December, has shown more willingness than his predecessor Urjit Patel to experiment with liquidity management in a bid to ease the transmission mechanism of his policies.

If banks don’t lessen their interest rates, consumers and businesses don’t benefit from RBI’s moves, and the overall growth impact of rate cuts is less than intended.

In an unexpected move late on Tuesday, the RBI announced a new set of open market operations to purchase a total of 250 billion rupees ($3.58 billion) worth of bonds in May, with the first auction for 125 billion rupees on May 2.

While these operations aren’t unusual, the timing of the announcement took markets by surprise, as it came immediately after the central bank’s second ever $5 billion buy/sell swap auction which has resulted in net infusion of nearly 700 billion rupees in the banking system.

The swap auctions were introduced last month to ensure banks had enough liquidity to be comfortable with lowering rates for their customers.

The infusing $2-3 billion of durable liquidity monthly is the only solution for transmission of RBI rate cuts to lending rate cuts, said an economist at Bank of America Merrill Lynch.

Sen Gupta expects the RBI to cut rates by another 25 bps in June on the back of benign inflation, which ran below the central bank’s target for an eighth straight month in March.

Traders who are trying to pick up the underlying in the RBI announcement also pointed to the five maturities it picked for the operation: 2020, 2023, 2026, 2028 and 2032. Yields on those bonds have been particularly stubborn.

Market yields on these papers have moved above the levels which were prevailing before the rate cuts, eveidently means that these cuts have had no impact, a trader at a private bank said.

After April’s cut, RBI’s Das said the central bank are cautious that the transmission of rate decisions had to be appropriate and effective.

Underscoring his frustration, State Bank of India, the country’s largest lender, has only cut its marginal standing facility rate by 5 bps this year.

Analysts say India’s interest rates are among the highest in Asia when adjusted for inflation and are affecting growth. India had the worst quarter in five at the end of last year and economists expect a further slowdown in January-March.