NHC Foods is on the verge of a remarkable transformation, with market analysts forecasting a threefold increase in its stock price within the next three months and a staggering tenfold rise over the next year. This bullish outlook stems from the company’s strategic initiatives and impressive financial performance, setting it apart as a strong contender in the market.

One of the key drivers of this optimistic projection is the company’s focused efforts to reduce debt and improve profitability. NHC Foods is repaying ₹15 crores in debt, which will cut interest costs and directly enhance net profit margins. Simultaneously, a ₹30-crore infusion into working capital is expected to boost sales and profits, strengthening the company’s financial foundation and improving investor confidence.

In addition to financial restructuring, NHC Foods is making significant strides in its operational expansion. The company has invested in a state-of-the-art sesame seeds plant in Pardi, Gujarat, set to become operational within 6–12 months. This facility is poised to enhance production capacity and meet rising demand in both domestic and international markets.

NHC Foods is also revitalizing its “SAAZ” spice brand, aiming to capture a larger share of the retail and e-commerce segments. The brand’s pilot launch is planned for Rajkot within the next 5–6 months, a strategic move to test market reception and build momentum for a broader rollout.

Furthermore, the company’s strategic investment in Buyceps, a promising venture, is targeting ₹100 crore in revenue over the next 2–3 years, further diversifying its revenue streams.

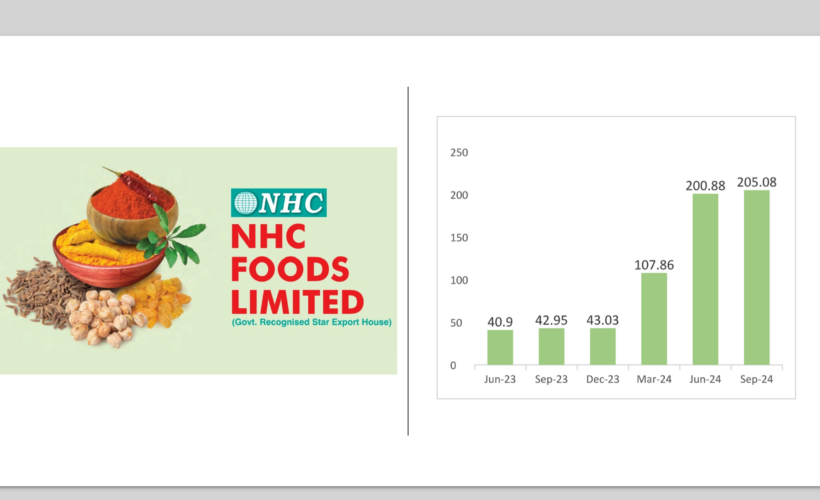

The company’s recent financial performance has been nothing short of exceptional. NHC Foods reported a net profit of ₹405.97 lacs in the first half of FY25, nearly doubling the ₹234.74 lacs recorded for the entire FY24. Year-on-year comparisons reveal even more impressive growth. In September 2024, the company posted a 377% increase in net profit, reaching ₹205.08 lacs compared to ₹42.95 lacs in September 2023. During the same period, revenue grew by 60.25%, from ₹4142.39 lacs to ₹6639.18 lacs. Similarly, in June 2024, net profit surged 391%, while revenue rose 73% year-on-year.

This stellar performance underscores the effectiveness of NHC Foods’ strategy, which combines advanced technology, robust research and development, product innovation, and market diversification. These factors are not only driving growth but also paving the way for sustained profitability and market leadership.

The company’s global footprint further enhances its appeal. As a 3-Star Export House, NHC Foods exports to over 30 countries, earning recognition for its popular brands such as Indi Bite, Eat’mor, and Saaz. This international presence strengthens the company’s revenue base and positions it as a major player in the global market.

Market experts are highly optimistic about NHC Foods’ potential, labeling it a multibagger stock. They advise investors to hold onto their shares, highlighting the company’s robust growth trajectory and the strategic initiatives that are likely to deliver exceptional returns. With a combination of financial discipline, operational expansion, and product innovation, NHC Foods is not only reshaping its business but also redefining its position in the industry.

Looking ahead, the company is well-positioned to capitalize on emerging opportunities in the food and spice sectors. Its commitment to leveraging cutting-edge technology and maintaining high standards of quality will continue to drive its success. As NHC Foods expands its market share, it is poised to achieve substantial revenue growth and profitability, solidifying its reputation as a leader in the industry.

For investors, this is a rare opportunity to be part of a transformative journey. With its ambitious plans and proven track record, NHC Foods offers the promise of unparalleled returns, making it a stock to watch in the coming year. Market watchers agree: the future is bright for NHC Foods, and the time to hold and grow with the company is now.