Mehul Kothari

Senior Technical Analyst, IndiaNivesh

Despite the range, bound movement, Nifty has again managed to close above 10880 which indicates that the triangle breakout is still intact and Nifty has a potential to sneak above 11000 mark. However, we also maintain our stance that 11200 still remains a very strong hurdle for the bulls.

Thus we would advise traders to start booking profits once index arrives near that zone. As of now, the support of 10620 has now been shifted to 10690. Only a move below the same might dwell the ongoing momentum. For the coming sessions, 10925 and 10770 would remain an intermediate resistance & support respectively for the markets. Currently, we advise traders to trade with a positive bias but avoid any over leveraged positions and follow strict stop loss.

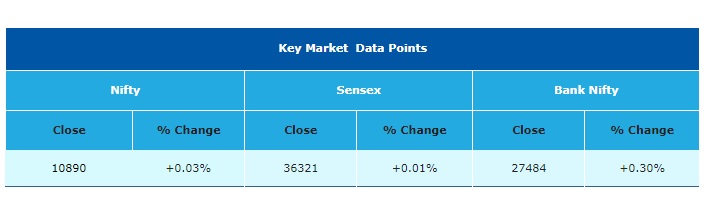

A sharp rally of Tuesday’s session was followed by sideways action during yesterday’s session. After a marginal upside gap opening the benchmark indices remained range bound to close flat. Index Nifty, oscillated in a band of 50 points to end the session with negligible gain.

Meanwhile, even the Nifty bank index displayed lethargic moves. In short, it was more of a consolidation session.

The market breadth remained extremely strong right from the beginning of the session due to broad-based buying. On the sectoral front, we witnessed a mixed bag of the picture wherein NIFTY MEDIA (-0.85%) stocks remained the biggest laggards whereas NIFTY PSU BANK (+0.60%) counters gained the most. From the F&O space, JETAIRWAYS (-14.81%), CUMMINSIND (-4.38%) and INFIBEAM (-3.91%) were the worst performers.