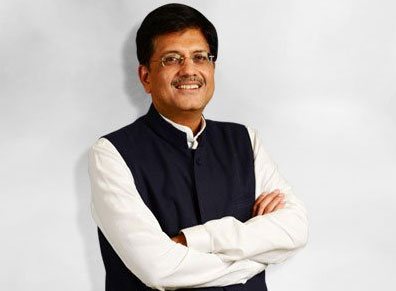

Interim finance minister Piyush Goyal pulled out the proverbial rabbit out of the hat. Despite all the fiscal constraints, Goyal managed to appease the middle-class with major tax cuts.

The Finance Minister had added that individuals earning an annual income of 5 lakh will not need to pay income tax. Moreover, these individuals will get a full tax rebate. The tax collection from FY14 to FY18 has also seen an 80% growth. Goyal also said that salary earners of up to ₹6,50,000 income don’t have to pay tax if they make tax related investments.

Among others

- Standard deduction to be raised from ₹40,000 to ₹50,000

- No tax if you own a second house.

- No tax on notional rent on second house

- Capital gains tax exemption under Section 54 raised to₹2 crore.

- Tax on notional rent on unsold inventory to not be paid for 2 years

Among other highlights for the Interim Budget:

-

India is poised to become a 5 trillion dollar economy in the next 5 years

- GST burden on home buyers to reduce. The GST Council is requested to set up a group of ministers who will now work on how to reduce the burden on homebuyers.

- Goyal has said that reducing tax for the middle class would be a priority.

- Direct tax collections from 6.38 lakh crore rupees in 2013-14 to almost 12 lakh crore rupees; tax base up from 3.79 crore to 6.85 crore

- Tax scrutiny will also be done electronically. There will be no interaction between the tax authority and the taxpayer.

- Direct tax system will be simplified. Direct tax will reduce and tax interface would be simpler and faceless to make life easier; resulting in increase in tax collections and return filings.

- The Finance Minister has added that in the last 5 years under all categories of workers, minimum wages has increased by 42% which is the highest ever.

- Tax collections have increased significantly from Rs 6.38 lakh crore in FY14 to almost Rs 12 lakh crore in FY19 with nearly 80% growth in the number of taxpayers, Goyal notes

- 34 crore JanDhanYojana accounts opened in last five years; Aadhaar almost universally implemented. It has ensured poor and middle class receive government benefits directly, said the Finance Minister.

- Govt announces PM Kisaan Samman Nidhi, farmers to get Rs 6,000 per year in three installments.

- Allocation for Northeastern region proposed to be increased to Rs 58,166 crore in this year, a 21% rise over the previous year: Piyush Goyal.

- Our government hopes to create 1 lakh digital villages in the next 5 years. Jan Dhan, Aadhaar mobile, and direct benefit transfer have been game changers, Goyal notes. Aadhaar is now near-universally implemented and helped ensure poor get the benefit of govt schemes directly in their bank accounts, he says.

- Allocation for North Eastern Region proposed to be increased to 58,166 crore in this year, a 21% rise over previous year: FM

- Piyush Goyal has added that there will be a 2% interest subvention to farmers for animal husbandry.

- Cost of data and voice calls in India is possibly the lowest in the world.

- Indian Railways budget outlay Rs 1,48,658 crore.

- Installed solar generation capacity in India increased by 10 times in the last 5 years.

- India has achieved over 98% Our soldiers are our pride and honour. One rank, one pension (OROP), pending for the last 40 years, has been implemented by us: Piyush Goyal.

- Already disbursed Rs 35,000 crore for our soldiers under OROP, Substantial hike in military service pay has been announced

- 2. 5.45 lakh villages declared to be open defecation free

- 3. #SwachhBharat now a national movement

- FM Goyal moves on the welfare of women in the country. Nearly 8 crore free LPG connections were planned to be provided to relieve women from use of woodfire for cooking. So far 6 crore connections have already been provided.

- Committee under NITIAayog to be set up to identify and denotify nomadic and semi-nomadic communities; Welfare Development Board to be set up under MSJEGOI for welfare of these hard-to-reach communities and for tailored strategic interventions

- No tax till Rs 5 lakh income for individuals taxpayers.

- Individuals with gross income up to 6.5 lakh rupees will not need to pay any tax if they make investments in provident funds and prescribed equities.

- Individual taxpayers having annual income upto 5 lakhs will get full tax rebate.