To provide additional source of income to over 25,000 brokers associated with it, Square Yards is introducing mortgage option on its ‘Square Connect Mobile App’ through which brokers will be able to offer home and other loans to their clients at best rates chosen from a clutch of 90 partner banks and NBFCs.

Brokers will now be able to provide their clients the best solution for loans, an important component in property purchase process in most the cases and earn higher commission for themselves as compared to what they would have earned by selling only property. This will also help Square Capital, the mortgage arm of Square Yards, to achieve multi-fold growth in the current levels of facilitation of around Rs 300 crore disbursements every month.

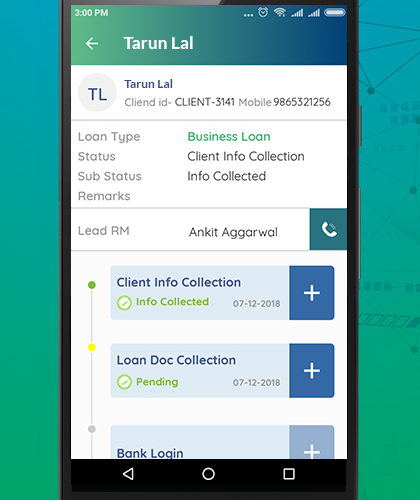

The brokers will be able to help their clients take advantage of cutting-edge software solutions that Square Capital uses for getting through a maze of complex valuation decisions at the hands of banks and excessive documentation. The technology related solutions that Square Capital uses enables it find out accurate eligibility of the applicant linked to credit bureau and various banks’ credit policies, ability to perform e-KYC of the applicants through integration with NSDL and direct integration with banks’ loan originating system.

“The channel partners associated with our company are a huge asset and we are constantly on a look out for ways to make the partnership we have with them stronger by offering them new technology tools as well as by supplementing their income. The new option of mortgage being added on the Square Connect App will help the channel partners in providing more touchpoints to their clients in the property buying process and consequently generating high income for themselves. The banks and NBFCs associated with us will also be able to get business from newer geographies as our channel partners are spread far and wide in the country,” said Tanuj Shori, Co-Founder and CEO, Square Yards.