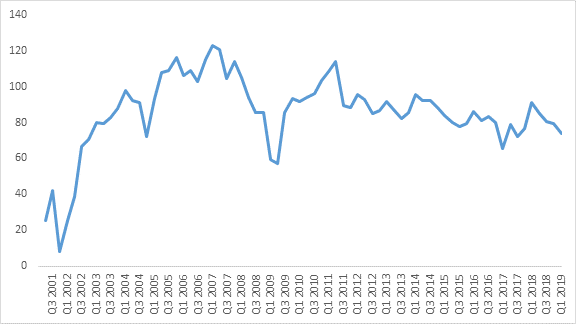

The Dun & Bradstreet Composite Business Optimism Index stands at 73.8 during Q1 2019, a decrease of 7.2% as compared to Q4 2018. Five of the six optimism indices have registered a decrease as compared to Q4 2018.

“The Dun and Bradstreet Business Optimism Index for Q1 2019 has declined from the previous quarter as well as from the same quarter of last year. In reading the Index, timing gives us the story behind the numbers. The responses for this quarter’s survey were received during December 2018.

The ruling party in Centre lost three states in the state elections, possibly leading to questions amongst businesses: whether we would have a new government in Centre, whether we would have a continued reform agenda and whether the various ambitious projects would stay.

Separately, there were a host of other unfavorable domestic events: an unevenly distributed monsoon, continued protests from farmers, loan waivers, subdued new investments, and fears of fiscal slippage.

Further, we had and continue to have apprehensions over the potential economic slowdown in USA and weakening world economic growth, adding to domestic growth concerns. Going ahead the announcements in the Union Budget 2019-20 and trepidations over the outcome of the General Elections is likely to weigh upon the sentiment of India Inc.” said Manish Sinha, Managing Director – India, Dun & Bradstreet.

71% of the respondents expect volume of sales to increase in Q1 2019 compared to 75% in Q4 2018, a decrease of 4 percentage points. While 18% expect it to remain unchanged, 11% expect the volume of sales to decline.

63% of the respondents expect an increase in net profits in Q1 2019, compared to 65% in Q4 2018, a decrease of 2 percentage points. 28% expect net profits to remain unchanged, while 10% expect it to decrease.

76% of the respondents expect no change in the selling price of their products for Q1 2019. 19% of the respondents expect the selling price of their products to increase during Q1 2019, while 5% expect a decline.

63% of the respondents expect their order book position to improve in Q1 2019, compared to 70% in Q4 2018. While 29% of the respondents expect new orders to remain unchanged, 8% anticipate new orders to decrease.

40% of the respondents expect an increase in the size of their workforce employed during Q1 2019, as compared to 33% in Q4 2018. While 56% anticipate no change in the number of employees, the remaining 4% expect their workforce size to decline.

22% of the respondents expect their inventory level to increase during Q1 2019, as compared to 32% in Q4 2018. While 64% anticipate no change in inventory level, 14% expect inventory level to decline.