Diamond News:

i. Alrosa sales rose by 38% y-o-y to $328.7 million in December’18. Moreover during December’18, rough-diamond sales increased by 42% to $323.7 million, while polished revenue dropped 47% to $5 million, according to Rapaport calculations.

ii. Sales made by Chow Tai Fook came down in China, Hong Kong and Macau markets due to uncertain economic conditions.

iii. Alrosa has announced to resume diamond-mining operations in Zimbabwe after a two-year break from the country. The company has decided to collaborate with the African country to develop joint exploration and extraction projects.

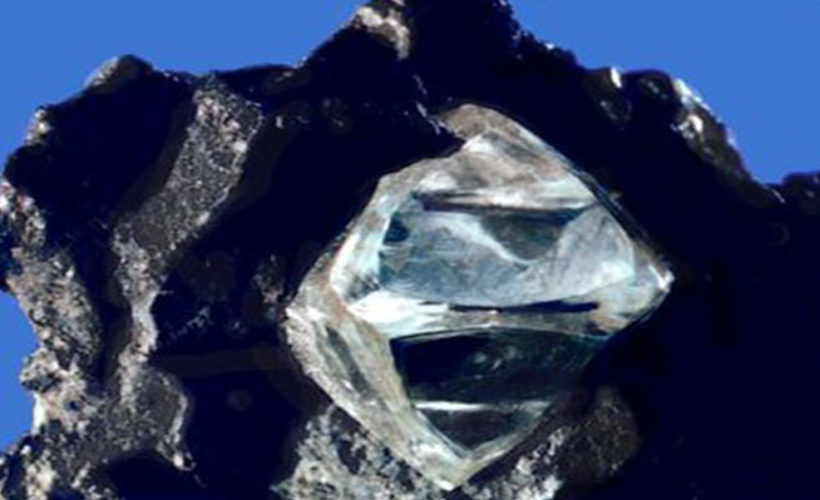

iv. Israeli exploration company Shefa Yamim has identified a new mineral while examining gemstones it had unearthed in the country. The miner has named the material carmeltazite, as it discovered it on Israel’s Mount Carmel, and its major chemical components are titanium, aluminum and zirconium.

v. Indian industry bodies are taking measures to prevent owners of bankrupt diamond companies from starting a new business without clearing their debts. The country’s Trade Disciplinary Committee (TDC) has notified that it could ban such new firms from carrying out business on the premises of member organizations.

Weekly Market Summary:

Sentiment improved after relatively good holiday season, but dealers and cutters concerned about low profit margins, excess supply, and selective demand. Indian bank credit tightening, with ICICI to close Antwerp branch. Stock markets rebound, with Dow index +2% since Jan. 1, amid optimism for US-China trade deal. Suppliers focused on Chinese New Year orders, with steady demand for lower-color and -clarity goods (G-J, VS-SI). Lab-grown producers gaining investor interest. Diamond Foundry to raise annual synthetic-rough production tenfold to 1M

cts. Tiffany & Co. declares geographical provenance of diamonds over 0.18 ct. De Beers approves changes to its disclosure rules.

Fancies: Fancy-shape market stable, driven by US and European demand for fashion jewelry. Ovals are best sellers, followed by Emeralds, Cushions and Pears. Supply shortage supporting prices for Pears. Radiants improving. Marquises and Princesses weak. Oversizes selling well.

Steady demand for fine-quality 6 to 10 ct. Ovals, Pears and Emeralds, with prices firming for 3 to 5 ct. due to shortages. Chinese consumers seeking fancy shapes at better prices. US supporting market for commercial-quality, medium-priced fancies under 1 ct. Off-make, poorly cut fancies illiquid and hard to sell, even at very deep discounts.

United States: Dealers slowly returning from New Year vacation; stronger trading expected from next week. Mixed feedback about holiday selling season. Good demand and short supply of excellent-cut VS2-SI1 diamonds. Jewelers note busy January, with a lot of repair work and giftcard purchases. Steady sales of engagement rings ahead of Valentine’s Day.

Belgium: Sentiment positive as dealers return from Christmas break.More confidence in European luxury market than Indian dealer trading. Steady interest in 1 to 2 ct., G-J, VS-SI diamonds. Dossiers weaker. Deep concern about credit scarcity and banks’ caution regarding the diamond industry. Rough sector quiet.

Israel: Companies uncertain about prospects for year ahead. Optimism for US demand, caution about China. Subdued local trading amid unease about new tax laws, with some companies considering relocating. Dealers bargain-hunting rather than focusing on niche specialties. Polished inventory levels stable compared to last year.

Hong Kong: Polished trading steady as jewelers prepare for Chinese New Year sales. Retailers reducing in-store inventory of larger certified goods, preferring to contact suppliers as orders come in. Solid market for 0.30 to 0.50 ct., G-J, VS1-SI2 diamonds. Good engagement-ring demand for 1 ct., F-J, SI diamonds with no fluorescence. Dealers shifting to lower colors and clarities to meet price points.

(Source: Rapaport News)