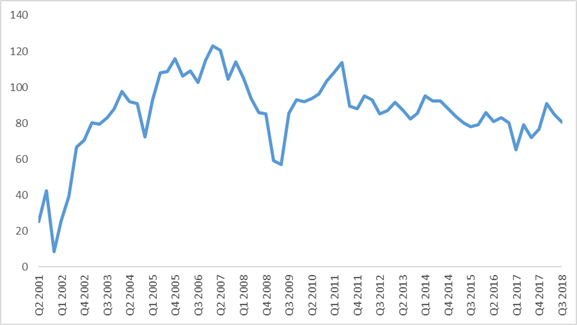

The Dun & Bradstreet Composite Business Optimism Index stands at 80.6 during Q3 2018, an increase of 11.7% as compared to Q3 2017. Four of the six optimism indices have registered an increase as compared to Q3 2017, while four optimism indices have declined when compared to Q2 2018.

“Dun & Bradstreet Business Optimism Index of India for Q3 2018 is now ready. As always we do two comparisons, one with Q3 2017 and the other with previous quarter. When compared with the same quarter of 2017, business optimism has improved. Mid-2017 was low as a result of implementation issues on Goods and Services Tax (GST) and ongoing effects of demonetization. So compared with that, current sentiment is better today. On the other hand, on a q-o-q basis, the index has declined due to the domestic and global headwinds.

Domestically, the rising NPA levels, the increase in inflationary pressures, rise in imported inflation on account of elevated crude oil prices, weak rupee and hike in policy rate in June 2018 has weakened the optimism level amongst India Inc. The possibility of another rate hike has increased given the inflationary pressures. On the external front, risks from geopolitical issues that threaten to keep oil prices elevated, a disorderly tightening of global financial conditions and escalating international trade tensions have not only weighed on the current optimism level but would continue to impact it in the near to medium term” said Manish Sinha, Managing Director – India, Dun & Bradstreet.

Around 74% of the respondents expect volume of sales to increase in Q3 2018 compared to 63% in Q3 2017, an increase of 11 percentage points. While around 20% expect it to remain unchanged, around 6% expect the volume of sales to decline.

67% of the respondents expect an increase in net profits in Q3 2018, compared to 55% in Q3 2017, an increase of 12 percentage points.24% expect net profits to remain unchanged, while 9% expect it to decrease.

66% of the respondents expect no change in the selling price of their products for Q3 2018. 27% of the respondents expect the selling price of their products to increase during Q3 2018, while 7% expect a decline.

72% of the respondents expect their order book position to improve in Q3 2018, compared to 65% in Q3 2017.While 24% of the respondents expect new orders to remain unchanged, 4% anticipate new orders to decrease.

37% of the respondents expect an increase in the size of their workforce employed during Q3 2018, as compared to 35% in Q3 2017.While around 57% anticipate no change in the number of employees, the remaining 6% expect their workforce size to decline.

29% of the respondents expect their inventory level to increase during Q3 2018, as compared to 31% in Q3 2017. While 58% anticipate no change in inventory level, 13% expect inventory level to decline.