RBI will be paying Rs 28,000 crore as interim dividend to the government. This amount would help the Centre meets its revised budget estimates which includes an allocation for the income transfer to farmers and improve fiscal credentials ahead of the income general election.

The central bank operates from a July to June financial year and distributes its dividends in August after annual accounts are finalized. The interim transfer will help the government receive a total of Rs 68,000 crore. Earlier, the RBI gave the government a total of 40,000 crore in August 2018.

This is the highest amount received by the RBI till date in a single financial year for the government, exceeding the Rs 65,896 crore it received in FY16 and Rs 40,659 crore in FY18.

“Based on a limited audit review and after applying the extant economic capital framework, the board decided to transfer an interim surplus of Rs 280 billion to the central government for the half year ended December 31, 2018,” the central bank said in a statement.

RBI had asked the government about the quantum of the interim dividend which had some bearing in the required estimates for FY19 presented in the interim budget.

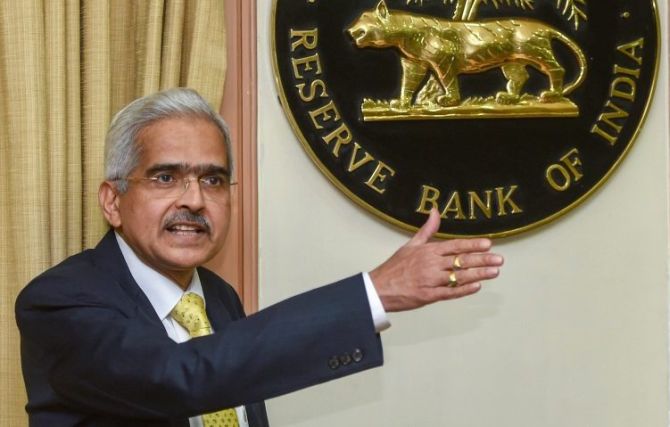

The government has asked for a transfer of the interim surplus and the amount retained by the RBI from past year’s surpluses. This was the reason why Urjit Patel resigned from his post as a governor. His successor is Shaktikanta Das, a former bureaucrat.

The finance ministry has said that the government has requested the RBI to provide at interim surplus for the financial year 2018-19 as per the analogy of a previous financial year and transfer the amount withheld.

In the last fiscal, the RBI had paid Rs 10,000 crore as an interim dividend in March, taking the total dividend by Rs 40, 659 crore for the year.

Bimal Jain, the former governor has set a committee to review the RBI’s economic capital framework.

Reserve Bank of India Governor Shaktikanta Das will hold a meeting with top officials of state-run banks and private sector lenders to discuss the rate cut of the RBI to further benefit the economy. The RBI rate cut interest rate by 25 basis points, its first in 18 months.